Leading Voices on Global Trade in a Fractured World

Across different disciplines and vantage points, leading thinkers converged on a shared message: global trade is not collapsing, but it is entering a more complex, politically charged, and strategically contested phase. The world economy is being rewired, yet the core structures of global integration remain intact. The question is not whether globalization will survive, but what shape it will take next.

These insights emerged when prominent economists, policymakers, and business leaders came to Zurich in 2025 at the invitation of the UBS Center. Speaking at the Wirtschaftspodium Schweiz in spring “Warum ist die Schweiz so reich und weshalb muss es nicht so bleiben?“ and the Forum for Economic Dialogue in fall “Global trade in crisis – what’s next?”, they offered complementary perspectives on the forces reshaping trade and on the choices facing Switzerland, Europe, and the global economy.

Evidence-based perspectives on global trade

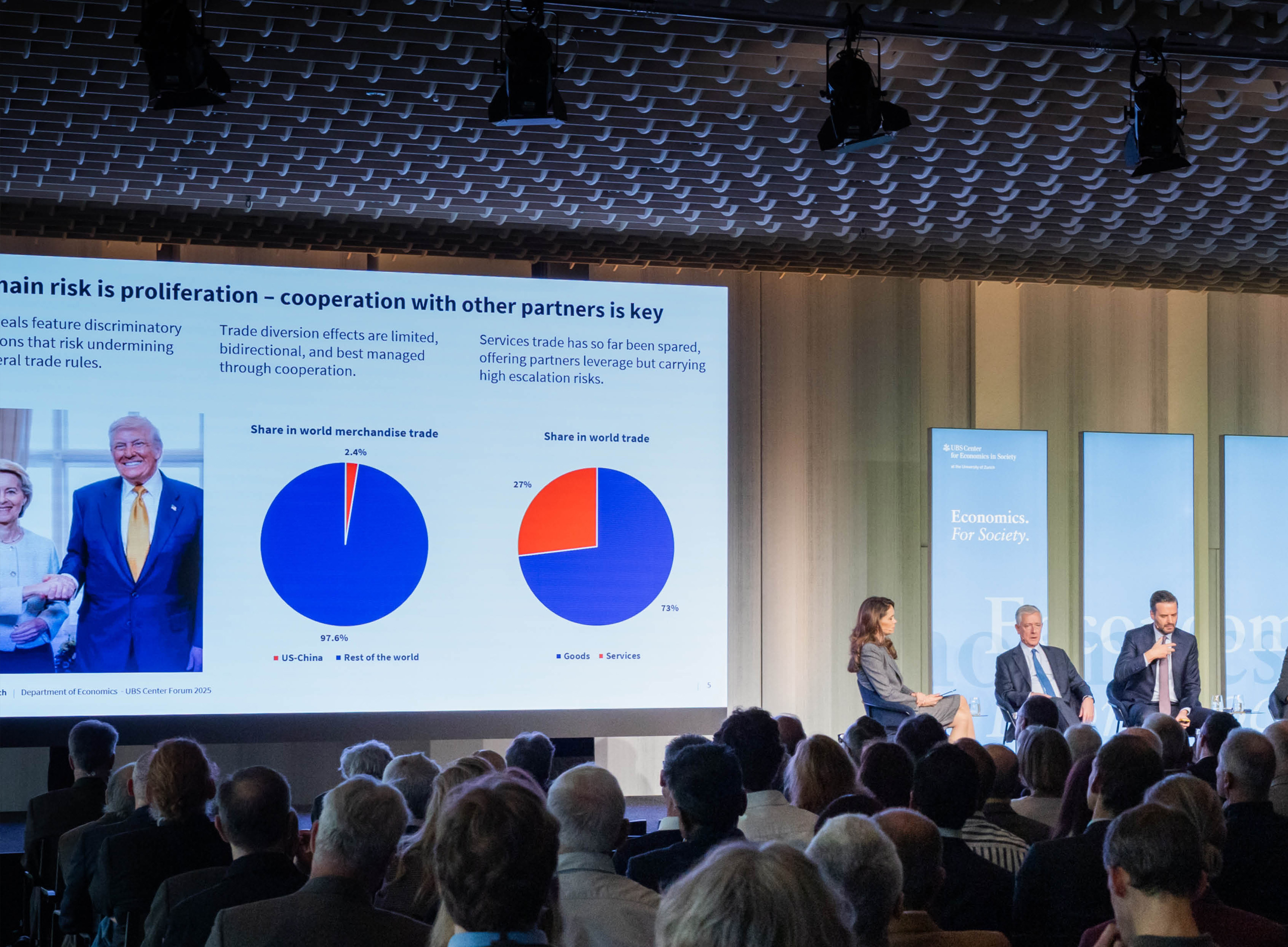

“72% of world trade is still conducted under WTO rules,” noted former WTO chief economist Ralph Ossa, cautioning against overstating the crisis. The U. S. tariff hikes were historically large, he acknowledged, but their global reach is limited: the U. S. accounts for just 14% of world imports. Declaring the rulebased order dead, he warned, risks turning narrative into reality. His outlook: more fragmentation, more uncertainty but no collapse of global trade.

“It was an unusual warning shot.” With this observation, CEPR Vice-President Hélène Rey highlighted a rare market reaction: on April 2, when new U. S. tariffs were announced, investors moved out of Treasuries and the dollar depreciated, the opposite of typical safe-haven behavior. Rey showed how global trade has shifted to a tripolar system anchored in the U. S., China, and the EU. Firms are already adapting, relocating production, redesigning supply chains, and passing on higher costs.

Power, currencies, and global order

“The fate of the dollar depends on the rule of law.” Barry Eichengreen, world-leading expert on global monetary systems, financial crises, and economic history, traced the resilience of the U. S. dollar, from its postwar ascent to its survival after the collapse of Bretton Woods. Its dominant role has endured largely because alternatives remain limited. Yet gradual erosion is possible, he argued, driven not by macroeconomic weakness but by political institutions and trust in the U. S. legal framework.

“It’s the ‘what’s next’ that links the trade shock to financial instability.” Former governor of the Reserve Bank of India Raghuram G. Rajan emphasized that trade tensions interact with domestic

vulnerabilities. The rule-based order has been weakening for years, he argued, not because of trade alone but because policymakers have failed to address the distributional effects of globalization. Political polarization, not tariffs themselves, may pose a deeper threat.

Switzerland’s position in a shifting global economy

Despite clear risks, such as trade diversion, discriminatory deals, and technology controls, several speakers highlighted opportunities. Europe could strengthen its geopolitical weight by completing the Capital Markets Union. Switzerland retains substantial advantages: strong institutions, stability, innovation capacity, and an economic model built on openness rather than protectionism.

“Switzerland is rich, but it does not have to stay that way.” With this warning, Federal Councilor Albert Rösti challenged the notion that Switzerland’s prosperity is automatic. He pointed to the institutional foundations that have long underpinned the country’s success: federalism, direct democracy, openness, and a culture of responsibility. These strengths, he argued, are under pressure from rising regulation and external shocks.

“We did not expect what has now happened,” added State Secretary Helene Budliger Artieda, referring to the abrupt U. S. tariff announcements in April 2025. Her verdict was pragmatic: resilience requires diversification, anchoring relations with the EU, keeping channels to the U. S. open, and engaging China where feasible. No single partnership can secure Switzerland’s economic stability.

A world in transition

Taken together, the voices that gathered in Zurich draw a coherent picture: globalization is not ending, but changing shape. Trade networks are being rewired, alliances recalibrated, and power redistributed. For Switzerland and Europe, the task is to remain open, agile, and grounded in the institutional strengths that have long supported their prosperity.

Full recordings of all keynotes and panel discussions as well as in-depth interviews with various speakers are available on the UBS Center website.